What is a Merchant ID Number & How to Find Yours

This article was published on August 8, 2019, and updated on September 9, 2025.

Running a business today almost always means accepting payments from customers in more than one way, credit cards, debit cards, and even digital wallets. To make all of that happen smoothly behind the scenes, you need something called a merchant ID number. If you’ve ever wondered “What is a merchant ID number and where can I find my merchant number?” you’re in the right place. In this blog, we’ll break it down in plain English so you’ll know exactly what it is, how it works, and why it matters to your business.

Key Takeaways

- A merchant ID number (MID) is a unique identifier that connects your merchant account to the payment processing system.

- Your MID ensures customer payments are routed properly from the customer’s bank account to your business bank account.

- You can find your merchant number on merchant account statements, POS terminal stickers, receipts, or by contacting your merchant service provider.

- Businesses with multiple locations or different business models may need multiple merchant accounts or multiple MIDs for better tracking and reconciliation.

- Keeping your MID secure and monitoring it through your merchant account statements helps prevent chargebacks, fraud, and payment errors.

What is a Merchant ID Number?

Think of your merchant ID number (MID) as your business’s digital fingerprint in the world of payments. It’s a unique 15-digit code assigned to you by your acquiring bank or your merchant service provider. This number is what connects your merchant account to the broader payment processing system.[source]

Whenever a customer makes a purchase using a credit or debit card, the merchant identification number tells the payment processor exactly where the money should go. Without it, the funds wouldn’t know how to find their way from the customer’s bank account to your business bank account. [source]

To put it another way, your MID acts like your bank account number, but it’s specifically tied to your merchant account. Just like you wouldn’t share your personal account number with strangers, you also need to keep your merchant number safe. If it falls into the wrong hands, it could lead to unauthorized transactions.

So, if you’ve ever asked yourself, “What is a merchant ID number?”, it’s simply the code that keeps your payment systems connected, secure, and functioning properly.

How Does a Merchant ID Number Work?

Let’s pull back the curtain on what happens when a customer makes a purchase at your business.

- The customer swipes, taps, or enters their card details.

- The payment gateway collects that payment information and sends it through your payment processing system.

- The payment processor communicates with the customer’s bank account to make sure the funds are available.

- Your acquiring bank receives the funds and deposits them into your merchant account.

- Finally, the money is transferred to your business bank account so you can use it for your business needs.

At every stage of this transaction process, your merchant identification number ensures the funds are routed properly. It’s the little identifier that keeps your payments moving in the right direction.

And here’s the kicker: every single specific transaction carries your MID in the background. That way, if you need to trace something later during the transaction reconciliation process, you (and your merchant account provider) can identify exactly where the payment came from and where it went.

Key Functions of a Merchant ID

So, what exactly does a merchant ID number do for your business? Here are some of the key functions you can count on:

Transaction Routing

Your unique merchant ID ensures all card payments, whether credit or debit card payments, get from the customer’s bank account to your merchant account.

Business Identification

Within the vast payment ecosystem, your MID is how processors, financial institutions, and networks recognize your business.

Security and Fraud Prevention

By tying each payment to your own merchant account, your MID helps prevent fraud and ensures money isn’t lost in the shuffle of millions of banking transactions.

Reconciliation

Your MID helps you match transactions against merchant account statements or even a bank statement, making it easier to keep your books in order.

Chargeback Monitoring

If you receive too many chargebacks, your MID is used to flag those transactions and alert your merchant service provider. This can be important for protecting your account from suspension.

What Are the Benefits of a Merchant ID Number?

Now that you know how merchant ID numbers work, let’s talk about why they’re so important to your business.

1. Smooth Payment Processing

Your MID is the reason you can accept card payments quickly and efficiently. Without it, you’d struggle to connect with the payment processing system.

2. Accurate Transaction Tracking

Having a unique merchant ID ensures every specific transaction is tied to your account. That’s critical when reconciling deposits against your merchant account statements.

3. Security

By linking payments to your merchant account, the MID keeps your funds safe and prevents them from being misrouted. Keeping this ID private also helps prevent chargebacks and fraud attempts from hitting the wrong account.

4. Flexibility for Growth

If your business has multiple locations or operates in different segments, you can set up multiple merchant IDs (sometimes called multiple MIDs) or even separate merchant accounts. This way, each branch or product line can have its own unique merchant ID for easier tracking.

5. Professionalism

Using a merchant account provider instead of relying on peer-to-peer wallets gives you more credibility with your customers and partners. It shows you’ve gone through the application process, completed credit checks, and set up with a recognized financial institution.

How to find your Merchant ID

Where Can I Find My Merchant Number?

If you’re thinking, “Great, but where can I find my merchant number?”, the good news is it’s easier than you think.

Here are the most common places to find your merchant ID:

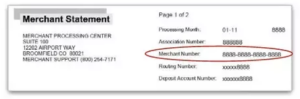

- Merchant Account Statements – Your MID is usually printed on the top right corner of your monthly merchant account statements.

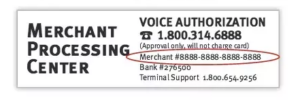

- Credit Card Terminal or POS Sticker – Many credit card processing companies place your merchant identification number on a sticker attached to your terminal or payment device.

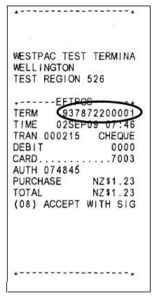

- Receipts – If you look closely at your card payment receipts, you’ll often see your merchant number listed there.

- Your Merchant Service Provider – Still not sure? Just contact your merchant service provider or merchant account provider directly. They’ll be able to confirm your ID number quickly.

Remember: this isn’t public information. You won’t find a list of merchant ID numbers online because each one is private and tied to an existing merchant. If you need to get a merchant ID for the first time, you’ll need to go through the application process with an acquiring bank or a merchant service provider.

Why You Might Need Multiple Merchant Accounts

Some businesses have just one MID. But for others, it makes sense to open multiple merchant accounts or request multiple merchant IDs.

For example:

- A retailer with multiple locations might prefer separate merchant accounts for each store.

- A company with different business types, say, an e-commerce shop and a subscription service, may use multiple MIDs to track each business model.

- Some businesses want more than one merchant ID to simplify their transaction reconciliation process.

Having multiple merchant setups makes life easier when you’re managing banking transactions, setup fees, or transaction fees across divisions. It also protects you if one part of your company experiences too many chargebacks. Instead of your entire business being at risk, only that specific merchant account is flagged.

Best Practices for Managing Your Merchant ID

Since your merchant ID number is such an important part of your payment infrastructure, it’s worth keeping a few best practices in mind:

Keep it Secure

Don’t share your MID carelessly. In the wrong hands, it could be misused just like your bank account number.

Check Your Statements

Always review your merchant account statements and bank statement to ensure all banking transactions are accurate.

Stay Organized

If you have multiple merchant accounts, clearly label them by business address or location so you know which id number belongs where.

Communicate with Your Provider

Keep your merchant service provider’s contact details handy. If there’s ever an issue with your payment systems, you’ll want help fast.

Monitor for Chargebacks

Keep an eye out for too many chargebacks. If your ratio gets too high, your merchant service provider may impose higher transaction fees or even suspend your account.

Summary

So, what is a merchant ID number? It’s the unique identifier that keeps your payment ecosystem running smoothly, ensuring money flows from your customer’s bank account into your business bank account. From accurate transaction reconciliation to fraud prevention, your merchant identification number is the unsung hero of your payment infrastructure.

And when someone asks you, “Where can I find my merchant number?”, you now know the answer: look at your merchant account statements, check your POS terminal, review a receipt, or call your merchant account provider.

Whether you run one store or manage multiple locations, keeping track of your merchant id is one of those behind-the-scenes tasks that helps your business accept payments, stay secure, and grow with confidence.

Ready to Secure Your Own Merchant ID?

If your business falls into the high-risk category, finding the right merchant service provider can feel overwhelming. That’s where First Card Payments comes in. From setting up your merchant account to providing tools that prevent chargebacks and lower transaction fees, our team specializes in helping high-risk merchants build reliable payment systems that actually work for their business model. Reach out today and get the support you need to accept payments with confidence.

Frequently Asked Questions

Is a merchant ID the same as a tax ID?

No, a merchant ID is for payments; a tax ID is for the IRS.

Do I need a merchant account to accept credit cards?

Yes, for stability and lower risk than third-party apps.

Can I transfer my merchant ID to a new provider?

No, each provider issues a new and unique merchant ID.

Why would I need multiple merchant IDs?

For multiple locations, business types, or sales channels.

Can I run more than one business on one account?

This is not ideal, it is better to use separate merchant accounts.

What should I look for in a provider?

Fair fees, fraud tools, and strong payment systems.

No Comments

Sorry, the comment form is closed at this time.