What Is an E-payment System?

Article posted October 2022 and updated in February 2023.

In a recent article, we discussed Metaverse payments and just how transactions might be conducted in the coming Metaverse boom. One common concern is safety, not just with transactions in the virtual reality dimension, but online transactions in general.

But we use e-payments every day. Online baking, direct deposit, auto bill pay, even purchasing the latest do-dad on Amazon…. These are all examples of e-payments.

And these e-payments are the backbone of our modern world. Without a solid digital architecture to handle all these payments, our current way of life would collapse. E-payments are just that important now. So let’s dive a little deeper into this magical realm of online payment systems.

Traditional Payments: Traditional payments are the payment methods most of us are used to which include cash, checks, and credit or debit cards.

These methods of payment have been widely accepted, used for many years, and are still popular today. However, innovation in the payment system market means new technology and new payment methods have emerged that offer more convenience and security. Enter the world of e-payments.

E-payments: E-payment systems are electronic. The internet or other electronic networks allow customers to make payments or transfer funds electronically without the need for physical cash or checks.

E-payment systems offer several benefits over traditional payment methods, including convenience, speed, and enhanced security. Transactions are also processed quickly, usually within seconds or minutes.

What Is An E-Payment System?

An e-payment system is a network of processes that are used to carry out a transaction for goods and services. Don’t worry about the techno terms here. E-payments can be summed into a 3 step process.

The Merchants Bank

When you use your card, your information is sent to the merchant’s bank. So if you swipe your card in a real store of if you use your card on Amazon, that information is transferred at light speed the bank where the merchant has an account.

The Card Network

The card network (think Visa, Mastercard, or American Express) will verify that your information is correct and then send the transaction details to your bank.

Your Bank

Your bank decided whether to approve or deny the transaction based on your account standing. That information then travels back through the system to the card network and then to the merchant’s bank.

How Did This All Start?

Great question. We’ve come a long way from cash and checks but it wasn’t that long ago that you had to watch a cashier enter your check information into a register.

So what’s the history of e-payments? Well, it all began in the 1950s when banks and stores began accepting card payments. That’s right, we can trace the beginnings of your online Amazon payment to the 1950s.

It used to be that your card was placed in a debit or credit card machine and swiped back and forth to create an imprint of you bank information. Later, store would send htis information to their bank and they would handle the processing of the information.

Now, this is all done automatically through the use of complex programs and payment processing systems.

Examples Of E-Payment Systems

As we’ve mentioned, you use e-payments all the time, and the technology is improving everyday. Soon we will be able to pay through facial recognition alone.

Here are some examples of the most popular e-payment systems in wide use today:

- Apple pay

- E-wallets

- Crypto

- Credit and debit cards

- Direct deposit

- Paying through apps directly

- E-check

Soon, e-payments systems will be used in the Metaverse and cryptocurrencies will join in the e-payment systems. Cryptocurrencies are a little more complex because they work on the blockchain system, a word you may have heard floating around the internet lately.

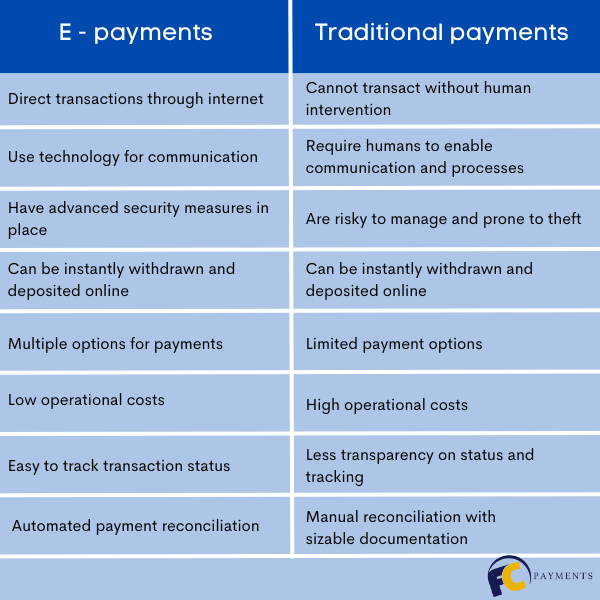

What Is the Difference Between E and Traditional Payments?

I am passionate about delivering results and helping my clients succeed. With my expertise in SEO, branding, and marketing, I lead the agency’s efforts to create and implement effective strategies that drive business growth. Our all-inclusive approach sets us apart from other digital media companies and ensures that our clients receive the full range of services they need for online success. If you can think of it, we can build it!

Zulu Shack Creative team members thrive on momentum. Like Zulu warriors, we strive to spearhead your idea with speed and quality.

When I’m not helping my team implement new digital marketing strategies, I enjoy playing music, hosting poker nights, reading Stephen King novels, and spending time with my wife and baby daughter.

No Comments

Sorry, the comment form is closed at this time.